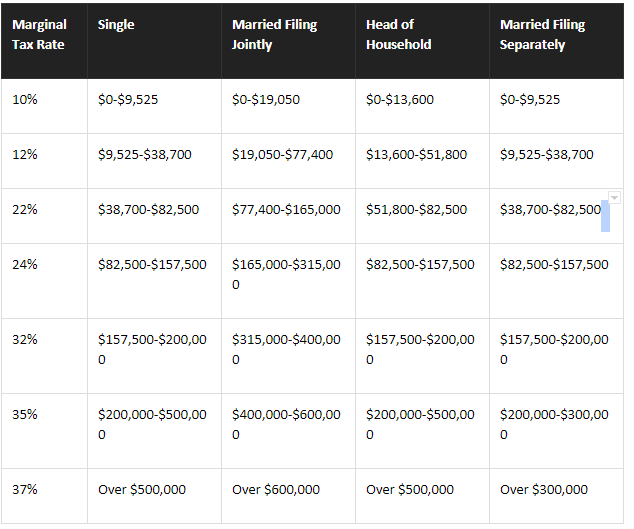

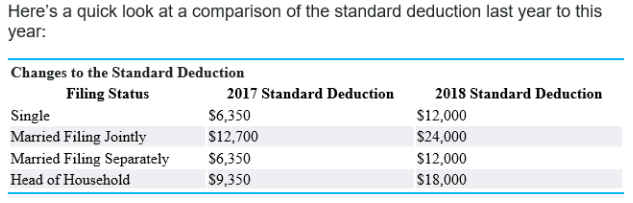

With the tax season upon us, many are wondering about how all the new Tax Reforms will affect them. Here is your quick guide to the most important changes 2018 Tax Brackets Standard Deduction and Personal Exemption The standard deduction has basically doubled for all filers, but the personal exemption has been eliminated. The marriage penalty is also gone. Child Tax Credit

Education tax benefits

Retirement Plans

Itemized Deductions Because of the effect of changes to the standard deduction and limitations on itemized deductions, the use of itemized deductions will likely be reduced for most taxpayers. The income based limit on overall itemized deductions has been eliminated. The following is a summary of changes to itemized deductions:

Mortgage Interest

Medical Expenses

BUSINESS TAX CHANGES! Passthrough Deduction for Qualified Business Income

Meals & Entertainment Business Expense Deductions

Want to book a consultation - click here!

1 Comment

10/27/2023 05:42:41 am

You're an undeniable expert in your field.

Reply

Leave a Reply. |

Archives

March 2021

|

|

ADDRESS: 2850 W. HORIZON RIDGE PKWY STE 200

HENDERSON, NV 89052 EMAIL: [email protected] PHONE: (702) 420-2408 |

|

Copyright PKJ Consulting © 2024

RSS Feed

RSS Feed