|

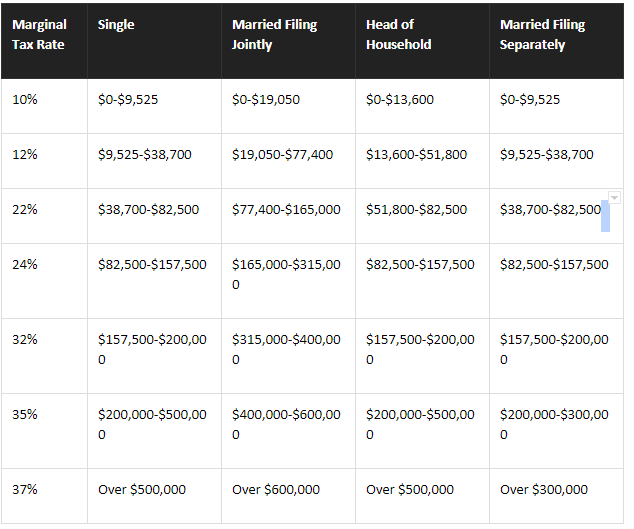

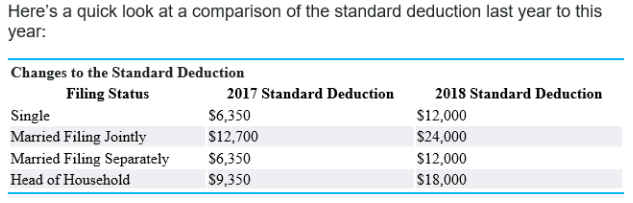

Many businesses today rely on a trusted accounting professional to handle their accounting needs. With the various changes and complexities to accounting it’s no question there is such as demand. For some, they are still hesitant to use outsourcing as a business practice. While risky for some situations, using an outsourced accountant can be very beneficial. Let’s review some key benefits to outsourcing your accounting needs. Expert advice One of the biggest benefits of outsourcing is a team or an individual whose main job is accounting. While you may know certain laws, certain write offs, or even certain tax breaks, there is no guarantee you know all there is to know when it comes to accounting. Going with a trusted accountant who eats and breaths accounting practices can increase your confidence in doing it right. Cost Savings Imagine saving money by only using a service when you need it- that’s exactly what you get when you outsource. You only need to utilize the service for specific aspects of your business. You save money by only paying for what you need while saving on not having an employee on payroll who only owns part of that role. The amount of time saved in staff time (and your time) will help with the bottom line. Minimize Risk Worst word you can hear: Audit. Yikes- it has and will happen to many businesses. One way though to minimize that risk is by hiring a professional who has studied and then studied again the new laws, changes, and options for a multitude of businesses. Outsourcing allows you to hire the best of the best while also increasing the chance you avoid the “A” word. Staying current Words like “confused”, “shocked”, “lost” and “why” have been uttered across the internet when polls went out about most people’s understanding of the new tax laws that recently went into place. There are a variety of tax law changes that go into effect each year, and an outsourced accountant is paid to keep track of them all. You do not need to fear the changes when you can rely on a trusted professional who knows them. Relevant systems There is something to be said for keeping up with the times. Phone books are near extinct, Blockbuster has one store left, and MySpace was just a distant nightmare. Staying relevant is vital when it comes to modern day comforts and accounting needs for any business. An outsourced professional has the most relevant systems in place to stay ahead of the curve and keep a watchful eye on your businesses needs. While a sticky pad and a well sharpened pencil may help with tax time, a professional may have a few systems in place to better track your numbers. Increase productivity Divide and conquer as the saying goes, is all too true in business. By finding people’s strengths and having them execute on them helps increase any businesses productivity. With accounting needs, outsourcing allows you the flexibility to focus on other aspects of the business, and gives the role of accounting to a professional. This decreases wasted time on crunching numbers. Support Last, but certainly not least is the amount of support offered by an professional. Not necessarily for emotional support, rather for technical support and guidance as the year unfolds. Business trends change, income and deductions vary, so why not talk them out with someone who knows how to manage it all? It’s wise to get ongoing assistance so you can take on the road ahead. Whether you are a new business or a well established one, it’s not too late to consider outsourcing your accounting needs. With PKJ Consulting we would be more than happy to help you get started. If you need to ask a question or you are ready to hand over the task to, we are here to help. Simply contact us HERE to get started!

2 Comments

If you have a small business or are considering the start of a new business idea, there are some considerations that should be explored before you get too far into this tax year. Running a business can be fun and exciting (and hopefully profitable), so understanding what type of business to form is crucial in setting up protections for your new venture. Setting up a business can be done as a sole proprietor, corporation, partnership, and more. There are however some key reasons to consider upgrading your business filing to an LLC or an S-Corporation. In the following post we will identify the top 5 reasons you should consider updating your filings to one of these statuses for your business.

|

Archives

March 2021

|

|

ADDRESS: 2850 W. HORIZON RIDGE PKWY STE 200

HENDERSON, NV 89052 EMAIL: [email protected] PHONE: (702) 420-2408 |

|

Copyright PKJ Consulting © 2024

RSS Feed

RSS Feed